When an injury or illness leaves you unable to work, navigating the right type of support can be overwhelming. Especially if you’re unsure which benefits apply to your situation. Some conditions are job-related, while others may arise outside of work, but they all impact your ability to earn a living. Knowing the difference can help you receive the support you need without delay.

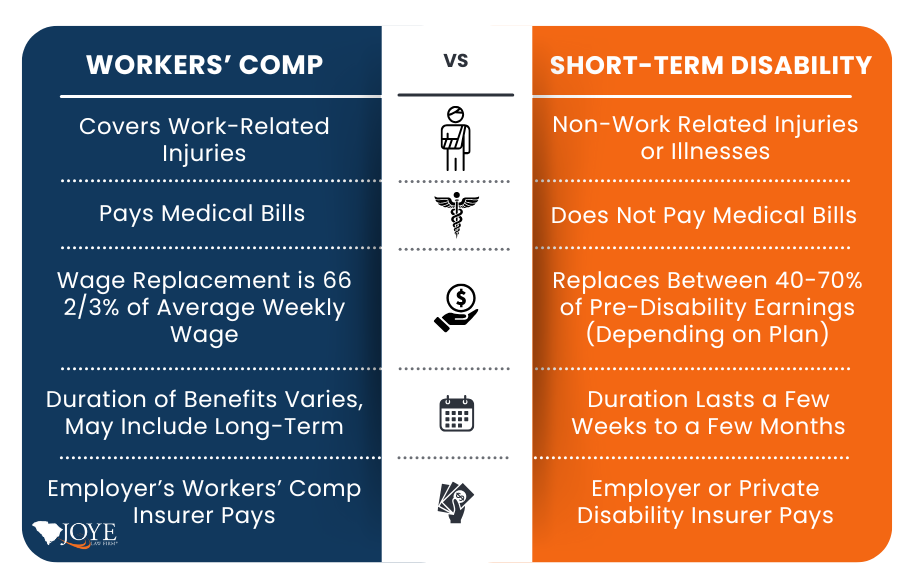

Short-term disability is a type of insurance policy that pays a percentage of your income if you’re unable to work due to injury. It often covers non-work-related injuries or illnesses and provides temporary financial assistance during your recovery. On the other hand, workers’ compensation is insurance purchased by your employer that helps when injuries occur on the job. In more severe cases, where you’re either not expected to make a full recovery or your recovery will take longer than a year, you may also qualify for Social Security Disability (SSD).

Joye Law Firm Injury Lawyers has guided thousands of injured South Carolinians through the complex benefits system after a life-changing injury. Clients frequently come to us unsure whether they qualify for short-term disability or workers’ compensation benefits. While these systems serve different purposes, they may overlap in complex situations. If you’re recovering from a work-related injury or a health condition that keeps you from working, it’s important to know how these benefits apply.

Whether you’re an employee with covered employment, a business owner, or simply want to understand your rights, this guide clearly breaks down the systems. If you still have questions, Joye Law Firm Injury Lawyers is here to help you make sense of it all. Since 1968, our team has helped our clients secure the benefits they need so they can focus on getting better.

We not only have a proven track record of results and thousands of positive client testimonials, we’ve also earned the respect of our peers. Our attorneys hold leadership positions in statewide legal organizations such as the South Carolina Association for Justice and Injured Workers’ Advocates. These roles reflect our ongoing commitment to improving the system for injured workers and advocating for fair treatment under the law.

Workers’ Compensation: How It Works in South Carolina

Workers’ compensation is a benefit system that protects employees who suffer workplace injuries or illnesses. If you are injured while performing your job duties, this program helps cover costs without requiring you to file a lawsuit against your employer. South Carolina law generally requires employers with four or more workers to provide workers’ compensation coverage. In a workers’ comp claim, you may receive:

- Full coverage for medical bills, treatment, and recovery.

- Partial wage replacement through workers’ compensation payments.

- Additional support if you reach maximum medical improvement but still can’t return to your previous job.

If your injury leads to permanently disability, you may also qualify for long-term benefits, no matter who caused the accident. What matters is that it happened on-the-job or as a direct result of your job duties.

Your doctor will monitor your condition and decide when you’ve reached maximum medical improvement (MMI), which is the point where more treatment won’t improve your condition. If you’re still unable to work at that stage, you might be eligible for social security disability insurance (SSDI) or long-term disability benefits.

Short Term Disability Insurance: When and How It Applies

Short-term disability insurance is designed for individuals who are unable to work due to illness or injury but don’t qualify for workers’ compensation benefits. These are usually non-work-related incidents. Examples include:

- Knee surgery

- Complications from childbirth

- Car accident outside of work hours

Unlike workers’ compensation, short-term disability doesn’t pay for medical expenses. Instead, it gives disability payments that replace a portion of your income while you’re out of work. This is often between 40% and 70% of your pre-disability earnings. Coverage typically lasts from several weeks to a few months, depending on the plan.

Many workers receive short-term disability coverage through their employer. Others use private disability insurance that they purchase individually. To make an insurance claim, you must submit medical documentation showing you are unable to perform your job duties.

Short-term disability claims often involve paperwork from both your doctor and your employer. Each insurance company has its timelines and rules. If you’re denied or facing delays, legal help may be useful. Joye Law Firm Injury Lawyers helps workers understand what benefits they’re owed and how to pursue them.

Can You Receive Both Short-Term Disability and Workers’ Compensation?

In certain cases, individuals may be eligible to receive benefits from both workers’ compensation and short-term disability. This usually happens when there is a dispute about whether the injury is work-related or when workers’ comp payments don’t cover everything.

For example, if you’re injured but your workers’ comp claim is still under review, you might start receiving short-term disability benefits in the meantime. Once your workers’ compensation claim is approved, you may need to repay those benefits, or they may be offset.

Workers’ compensation insurance does not pay the full amount of your wages. The maximum weekly compensation rate equals 66⅔% of an individual’s average weekly wage up to the maximum amount decided by the South Carolina Workers’ Compensation Commission each year. For 2025, injured workers’ weekly wage replacement benefits are capped at $1,134.43. If allowed by your plan, short-term disability could help cover the difference. However, not all policies permit this, and not all injuries are eligible.

It’s essential to avoid “double-dipping,” where an individual receives two full payments for the same period. Insurance companies track this closely. Our attorneys at Joye Law Firm Injury Lawyers often help injured workers navigate these issues, especially when both systems are involved. We help you obtain the financial support you’re entitled to while ensuring your claims are accurate and compliant with the law.

What Happens When Recovery Takes Longer Than Expected?

When injuries or illnesses last longer than the coverage provided by short-term disability, other programs may be applicable. Long-term disability insurance is one option. This type of disability insurance usually kicks in after short-term benefits end. It can last for years, even until retirement age.

To have a successful claim, you must prove you still can’t return to work. The insurance company may ask for updated information, including:

- Medical evidence

- Job descriptions

- Progress reports

Some plans reduce payments if you’re receiving social security benefits or workers’ compensation payments. Filing for Social Security disability insurance, which is administered by the Social Security Administration, may be an option for individuals with long-term or permanent disabilities. Approval can take months, and many people are initially denied.

At Joye Law Firm Injury Lawyers, we help clients understand and secure the workers’ comp benefits they’re entitled to under South Carolina law. When you’re facing short-term disability, medical expenses, and uncertainty about returning to work, having knowledgeable legal support can make a major difference in your outcome.

Understanding SSD and Other Public Disability Benefits

Social security disability helps workers who become seriously ill or injured and can’t return to work. To qualify, you must meet strict rules set by the Social Security Administration, including having enough work credits and a disabling condition expected to last at least a year.

If approved, you’ll receive monthly SSD benefits based on your average current earnings. These disability benefits can last for years and may include access to Medicare after a waiting period.

Depending on your income and assets, you may qualify for other public disability benefits, including Supplemental Security Income (SSI). It’s important to note that receiving Social Security payments may affect what you get from workers’ comp or private disability insurance.

Case Study:

After suffering a serious back injury on the job at his family’s auto shop, Marlon faced not only physical pain but also emotional strain. His own brother, the shop owner, refused to believe he was hurt and denied him access to medical care and workers’ compensation. As his condition worsened and his requests for help were ignored, he turned to Joye Law Firm Injury Lawyers for legal guidance. Attorney Ken Harrell fought through a contentious hearing process, successfully proving that Marlon’s injury was work-related. Despite the employer’s attempts to discredit the claim, Marlon ultimately secured $127,000 and medical treatment after a favorable ruling was affirmed on appeal.

However, the long delay in treatment left Marlon with permanent nerve damage and chronic pain, eventually making him unable to return to any type of manual labor. Joye Law Firm Injury Lawyers didn’t stop at workers’ compensation; we also guided Marlon through the Social Security Disability process. With help from attorney Matt Jackson, Marlon was awarded monthly SSD benefits, ensuring some financial stability moving forward.

How to File a Claim and What Documents You Need

Whether you’re applying for workers’ comp, short-term disability, or SSD, each system requires documentation.

- For workers’ compensation, you must report your workplace injury promptly and receive treatment from an approved doctor. Save all medical records, keep track of your lost wages, and document how your injury limits your ability to work.

- For short-term disability, you’ll need a doctor’s statement, an employer form, and possibly payroll records. Your insurance company will want proof of your condition and the time missed from work.

- SSD applications require detailed medical evidence, work history, and functional assessments. Many people are denied due to missing or incomplete information.

Each benefit has deadlines. Missing them can lead to a loss of income. That’s why having organized records and legal guidance can help you avoid delays. At Joye Law Firm Injury Lawyers, we assist injured clients in gathering evidence, negotiating with insurers, and filing claims in a timely manner, allowing them to focus on their recovery.

FAQs About Short-Term Disability and Workers’ Compensation

WC Short-Term Disability

What if my employer doesn’t offer short-term disability coverage?

If your job doesn’t provide short-term disability coverage, you still have options. You may purchase private disability insurance independently. In some cases, you may qualify for public disability benefits such as SSD or SSI, If your condition is work-related, you may qualify for workers’ compensation. An attorney can help you explore available disability benefits.

Does workers’ compensation affect my eligibility for unemployment benefits?

Yes. If you’re receiving workers’ compensation payments for a job-related injury, you’re typically not considered “able and available” for work, which is a requirement for unemployment benefits. However, in cases where you’re cleared for light-duty work but can’t find it, limited unemployment benefits may still be available.

Are mental health conditions covered by short-term disability or workers’ comp?

Potentially, yes. Both systems may cover mental health conditions, like anxiety or PTSD, if properly documented. For workers’ compensation, you’ll need to prove that the condition is a result of a workplace injury or occupational stress. For short-term disability benefits, medical documentation and diagnosis are key to qualifying.

Can I get a lump sum settlement for my workers’ comp case?

Yes, many workers’ comp cases resolve with a lump sum settlement, especially if you’ve reached maximum medical improvement (MMI). This is a one-time payment that may cover medical expenses, future treatment, and partial wage replacement.

What if my workers’ compensation claim is denied?

If your workers’ compensation claim is denied, you have the right to appeal. In South Carolina, this involves requesting a hearing with the Workers’ Compensation Commission. You must present evidence and documentation of the occupational injury. Legal representation can improve your outcome.

Call Joye Law Firm Injury Lawyers to Get the Workers’ Compensation Claim and Disability Insurance Benefits You Deserve

At Joye Law Firm Injury Lawyers, we’ve been helping injured workers and their families across South Carolina since 1968. Whether your case involves short-term disability coverage, a denied workers’ comp claim, or a need for legal assistance with SSD, we can help you understand your rights.

You deserve clear answers about what your insurance policy covers, what benefits are available, and how to get help. With proper planning and legal guidance, it’s possible to receive all the benefits you’re entitled to, without confusion or delay.

Call Joye Law Firm Injury Lawyers today at (888) 324-3100 or schedule a consultation online to review your case. There’s no obligation, and your consultation is free. Let us help you get the financial support and peace of mind you need to move forward.