If you have been disabled by an occupational accident or disease, you may qualify for both South Carolina workers’ compensation and Social Security Disability (SSD) benefits. But your workers’ comp payment could be used to reduce the benefit you receive from the Social Security Administration.

If your total disability payments exceed 80 percent of your average weekly wage, the excess may be deducted from your monthly SSD benefit. It is understandable that few workers know about this quirk of federal SSD program rules, which is called a “workers’ compensation offset.” But this lack of knowledge could be costly.

To find out how we can help you, call us at (888) 324-3100 or fill out our online contact form for a free and confidential claim evaluation.

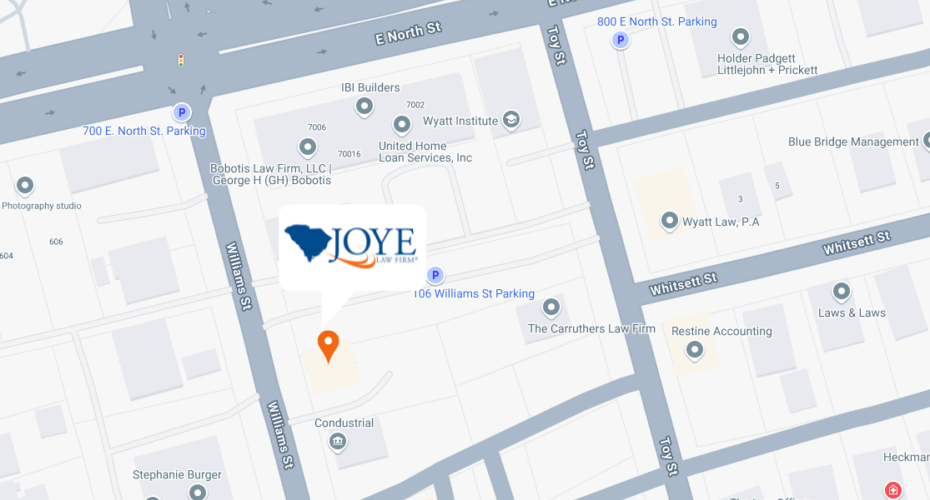

Our South Carolina lawyers at Joye Law Firm understand state and local worker’s disability programs, including how a workers’ compensation offset is calculated in a disability claim. We help our disabled South Carolina workers’ comp clients structure their workers’ comp settlements as to minimize any offset of SSD insurance benefits they receive.

Find out how we can help you today. Contact our South Carolina personal injury attorneys today by calling (888) 324-3100 or use this online contact form.

SSD Workers’ Compensation Offset

SSD is a federal program that assists workers who have become ill and unable to work for a living. Workers’ compensation is a state program that provides benefits to workers who have been hurt or become ill on the job and cannot work due to their job-related injury or condition. Some people are entitled to benefits under both systems.

Both programs have complicated rules and regulations. One crucial rule for the federal SSD program that is not well known can cost disabled workers and their families thousands of dollars.

If you receive a weekly workers’ compensation payment or other disability benefits, they may be counted against your monthly SSD benefit, including SSD benefits paid to family members. This is known as the “workers’ compensation offset.”

The offset is applied if your total disability benefits exceed 80 percent of your average weekly wage prior to your disability.

Your total benefits include:

- Workers’ compensation

- SSD, including family benefits based on your earnings record.

Other public disability benefits paid under any federal, state or local public law or plan

Any amount of the total benefit that exceeds 80 percent of your weekly earnings will be deducted from the SSD payment you receive.

The offset is calculated the first month that you receive both SSD benefits and workers’ compensation benefits or other public disability benefits. This can be especially important if you are to receive a lump-sum workers’ compensation settlement.

Like many government programs, the SSD program rules that regulate the workers’ compensation offset have many variables and exceptions that go into the calculations that are made. Knowing them ahead of time can enable you to structure a workers’ compensation settlement in such a manner that it has the least possible effect on your SSD benefit.

Contact a Workers’ Comp Lawyers From Joye Law Firm About Your Social Security Disability Claim

Our attorneys at Joye Law Firm can help you obtain the full amount of assistance you need and deserve if you can no longer work for a living. A properly structured workers’ compensation settlement can ensure that you do not lose an inappropriate amount of money due to the SSD workers’ compensation offset.

Source: