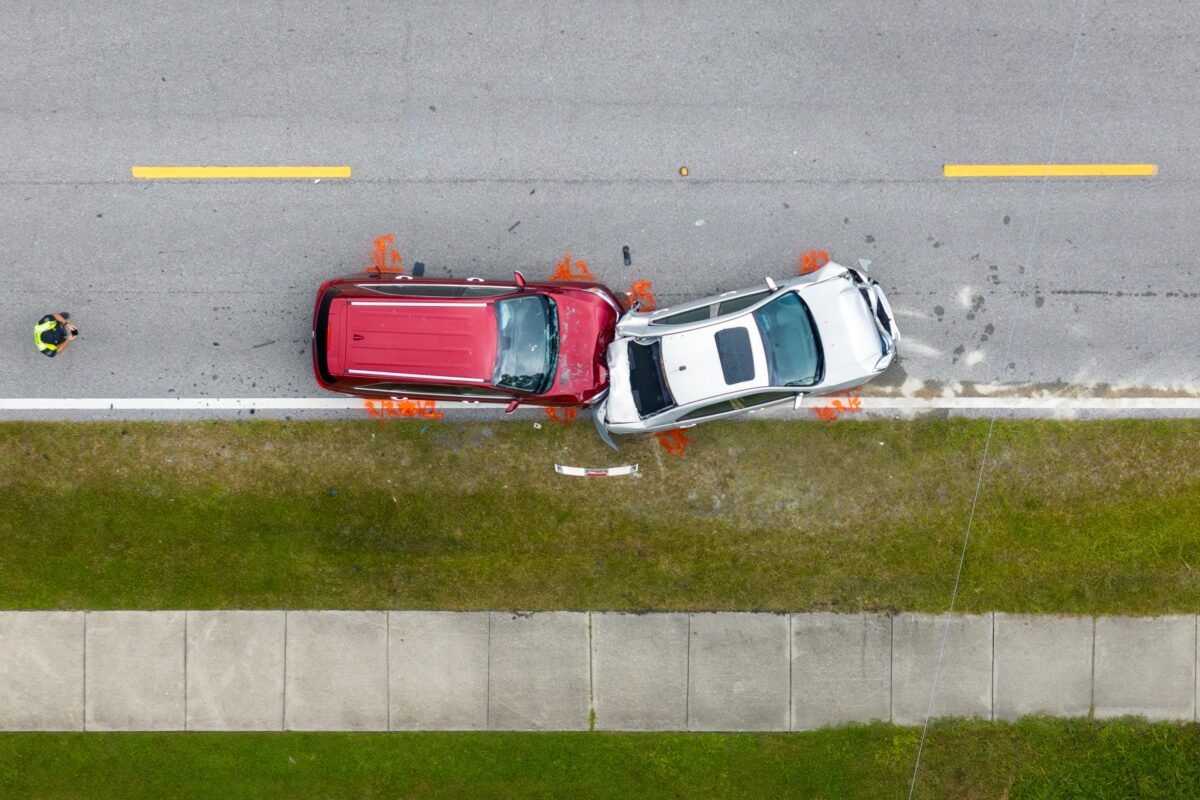

After a car accident caused by another motorist, your health insurance may pay your medical bills or other costs related to the accident. Afterward, you may receive a notice that your insurer will pursue subrogation against the other driver’s insurance in the accident. What does subrogation or “subro” mean, and how might it affect you financially?

If you have been hurt in a South Carolina car accident that wasn’t your fault and you have questions about subrogation, contact Joye Law Firm for a free claim evaluation. For more than 55 years, our attorneys have worked to protect the rights and interests of accident victims across South Carolina. Our personal injury law firm has successfully handled thousands of cases on behalf of injured people like you. Let our firm guide you through the process of seeking just compensation after an accident that wasn’t your fault.

What Is Subrogation?

Subrogation is a legal process that allows your insurance provider to recoup its costs from the at-fault party. To “subrogate” means to substitute one for another. In this instance, your insurance company, after paying your claim, has the right to seek reimbursement from the at-fault driver or their insurance provider for accident-related costs like your medical bills, car repairs, and other damages. That is known as the right of subrogation.

After your insurer pays you for your accident losses, it can file a subrogation claim against the at-fault driver’s liability insurance to recover the money it gave you. The subrogation process generally involves insurance companies dealing directly with each other.

When Does Subrogation Happen?

Subrogation can occur after another driver causes a wreck, resulting in injuries or vehicle damage. You may have coverages in your own auto insurance policy that allows you to seek reimbursement for accident-related losses from your insurer. These coverages may include:

- MedPay or Personal injury protection (PIP): Provides reimbursement for medical expenses and lost wages incurred due to car accident injuries

- Collision coverage: Pays for car repairs to fix accident damage

- Uninsured/underinsured motorist coverage: Pays you for losses you have the legal right to recover from an at-fault driver who does not have liability insurance or whose policy limits will not provide you with full reimbursement of your losses

If you file a claim against your own insurance policy, your insurer may issue you a check for your losses minus any applicable deductibles. The insurer may then pursue a compensation claim against the at-fault driver’s insurance provider. If your insurer successfully recovers compensation from the other driver, they may reimburse you for all or a portion of your deductible.

How Does Subrogation Work?

In most cases, subrogation claims only involve insurance companies and are handled behind the scenes. A subrogation claim begins when your insurer sends a subrogation letter to the at-fault driver and their insurance company. This letter outlines the subrogation claim, including evidence of the driver’s fault and the amount of money your insurer paid you. The at-fault driver’s insurer will then work out reimbursement with your insurance provider.

Once insurers resolve a subrogation claim, the policyholders will receive notification of the settlement. Your insurer may reimburse any deductibles you paid if your insurer received more than the money it paid you. However, if your insurer did not recover the full cost of the compensation it paid you, you may not receive any reimbursement for your deductibles.

Insurers may choose to mediate, arbitrate, or litigate a subrogation claim if they disagree over fault for the accident or the amount of compensation paid to you. Your insurer will handle any litigation if the subrogation claim goes to court.

Some of the factors that may affect the duration of a subrogation claim include:

- Whether the evidence conclusively demonstrates the other driver’s fault

- Whether other parties may share fault for causing the accident

- Whether the at-fault driver’s insurance company disputes the amount of compensation you received from your insurer

- Whether the at-fault driver lacks liability insurance, which would force your insurance company to pursue compensation directly from the driver

Of most interest to a person injured in an automobile collision is how their medical bills be paid. An injured party can submit their medical bills for payment to health insurance, just like they would in any other situation. But it is important to know that if a settlement is reached with the auto insurance carrier, the injured person’s health insurance must be paid back. Many people who try to resolve their accident cases on their own, without an attorney, forget to honor their subrogation lien, which can result in a suspension of benefits.

It is also important to note that not all personal injury settlements are subject to subrogation. First-party coverage, like uninsured and underinsured coverage, are typically not proceeds a health insurance carrier can seek reimbursement from. There are exceptions to this (ERISA plans, Medicare and Tricare, for example).

It is important to seek out legal counsel in injury cases where health insurance has been used to pay for medical treatment. It is not safe to assume that the automobile carrier will properly take care of any outstanding subrogation liens when a case is settled.

What Is a Waiver of Subrogation?

A waiver of subrogation is an agreement that precludes your insurance company from pursuing your car accident claim to recoup the money it paid you. Waivers of subrogation typically arise during settlement negotiations between an injured party and the at-fault driver’s insurer.

By cutting out the injured party’s insurance company, the at-fault driver’s insurer attempts to ensure that any settlement finalizes the matter.

Before you sign a waiver of subrogation or any settlement agreement that includes a waiver of subrogation clause, you should first consult with an attorney. Many auto insurance policies prohibit insureds from signing waivers of subrogation without the insurance company’s approval. If you agree to a waiver of subrogation without notifying your insurer, your insurer may pursue a legal claim against you for breaching the terms of your insurance policy.

Contact Our Car Accident Attorneys for Help

Hurt in a car accident caused by someone else and wondering how subrogation could affect your claim? Call Joye Law Firm today at 888-324-3100 for a no-obligation consultation. Our car accident attorneys can help you understand how subrogation might affect your rights to pursue compensation for your injuries and losses.