Every driver in South Carolina is required to have proof of insurance in order to legally drive. You may be required to purchase some forms of coverage while others are optional, and you must purchase a certain amount of coverage, but will also have the option to purchase more if you wish to.

For example, in South Carolina, all drivers are required to purchase both liability coverage and uninsured motorist coverage. Not all states require uninsured motorist coverage, but South Carolina does.

Insurers are also required to offer underinsured motorist coverage, although you are not required to purchase it.

How Much Insurance Do I Need to Protect Myself After a Crash?

Buying as much coverage as you can afford is recommended when purchasing auto insurance to protect yourself after a crash. Accidents can result in costly property damage and personal injury, and having adequate insurance can provide you with peace of mind and financial protection.

While it may be tempting to purchase the minimum insurance required, you may need more to cover all the damages you could incur in an accident.

What is the Minimum Requirement in South Carolina?

South Carolina requires all drivers to carry a minimum amount of liability insurance coverage to operate a vehicle legally. This insurance only covers damages you cause to other people and their property. The minimum insurance requirements in South Carolina are often referred to as 25/50/25 coverage and include:

- $25,000 bodily injury coverage per person

- What this means: Insurance will pay up to this much in medical expenses for someone injured in the crash. If their medical expenses turn out to be less than $25,000, insurance will pay that much but not the full $25,000.

- $50,000 bodily injury coverage per accident

- What this means: Insurance will pay up to this much in medical expenses for people injured in the crash but won’t pay more than this. This amount also overrides the “per person” amount. That means if three people were injured and they all had $25,000 worth of injuries, insurance would not pay $75,000; it would only pay $50,000.

- $25,000 property damage per accident

- What this means: Insurance will pay up to this much for all property damage combined (vehicle damage, plus personal property inside the vehicle that was damaged, plus any other property that was damaged, such as buildings).

The state also requires drivers to carry uninsured motorists (UM) insurance with the same 25/50/25 minimums as liability insurance. UM policies typically have a $200 deductible and provide coverage for you or your passengers if you get into an accident with a driver who doesn’t carry insurance.

Other typical amounts of coverage that may be offered include:

- 50/100/50 (we recommend this as the minimum amount you should purchase, if at all possible)

- 100/300/100

- 250/500/250

Should You Buy More Than the Minimum?

While meeting the minimum insurance requirements is essential, buying more than the minimum coverage can provide you with additional protection. Some reasons why you should consider purchasing more than the minimum insurance coverage include:

Protection for Your Assets

If you are found to be at fault in an accident, the damages and medical expenses could quickly exceed the minimum insurance coverage limits. If this happens, you could be held liable for the remaining costs, which may place your personal assets at risk. Purchasing additional liability coverage helps protect your assets and reduce your risk of financial hardship.

Coverage for Underinsured Drivers

If a driver with a minimum-limits policy hits you, you may be left with expenses their insurance policy doesn’t cover. Underinsured motorist (UIM) coverage pays for your injuries or property damage if the at-fault driver does not have enough insurance. South Carolina doesn’t require UIM, but auto insurance companies must offer it.

What the Different Types of Coverage Mean

While South Carolina only requires liability and uninsured motorist coverage, there are other types of insurance that are typically available. We go over all of the main types below, including when they can be used.

- Liability Coverage: This type of coverage does NOT help you pay for any of your expenses after an accident! Instead, this type of coverage protects you from having to pay for other people’s crash-related expenses out of your own pocket if you are at fault for an accident. Liability coverage will pay for the medical expenses and vehicle repair costs for the other driver, as well as any passengers, when you are at fault. If the other driver is at fault, their liability coverage will pay for your medical expenses and vehicle repairs.

- Collision Coverage: This type of coverage WILL help you pay to repair your vehicle after a collision, even if you were at fault for the crash. Without collision coverage, you’ll be stuck paying out of pocket to fix your car if you were at fault for the crash.

- Comprehensive Coverage: This type of coverage covers all vehicle damage that happens outside of a crash. For example, if your vehicle was vandalized, broken into, damaged by hail, or damaged by an animal, your collision coverage won’t pay to fix it, but comprehensive coverage will.

- Medical Payments Coverage: This type of coverage helps pay for your medical expenses after a car accident, even if you were at fault for the crash. However, it’s usually only sold in small coverage amounts ($5,000 as opposed to $25,000, for example), so it shouldn’t be your only way of paying for crash-related medical bills!

- Uninsured Motorist Coverage: If you are hit by a driver who is illegally driving without insurance, you can’t file a claim through the liability insurance they don’t have, so instead you’ll need to file a claim with your own insurance through your uninsured motorist coverage.

- Underinsured Motorist Coverage: This type of insurance works the same way as uninsured motorist coverage, but it kicks in when your medical expenses are more than the at-fault driver’s insurance limits. For example, you’d use this if the at-fault driver only bought $25,000 worth of bodily injury liability coverage, but you have $30,000 in medical bills from the crash.

Your Auto Insurance May Also Cover Additional Perks

Depending on the type of insurance you bought, you may also be entitled to other benefits from your auto insurance provider. For example, it’s common for insurers to offer some roadside assistance benefits or other crash-related expenses, such as:

- Paying for your vehicle to be towed to a repair shop

- Paying for a rental car while your vehicle is being repaired

- Emergency travel expenses (typically hotel and food) if your crash happens far from home

Some of these benefits may apply even after a breakdown unrelated to a crash. Make sure to check your auto insurance policy to see what is included.

What Benefits Does Well-Rounded Coverage Provide?

Well-rounded insurance coverage can provide a range of benefits for drivers in the event of an accident. Some benefits of carrying more than the minimum required insurance coverages include:

Protection for Your Vehicle

Comprehensive coverage options, such as collision and comprehensive coverage, can help protect your vehicle from damage caused by collisions, theft, weather events, and other incidents.

Protection for Yourself and Your Passengers

Personal injury protection (PIP) and medical payments coverage can help cover medical expenses and lost wages if you or your passengers are injured in an accident. Although PIP isn’t required in South Carolina, most insurance companies offer it.

Protection for Other Drivers and Their Property

Liability coverage is essential for protecting other drivers and their property if you are found to be at fault in an accident. By carrying higher liability coverage limits, you can ensure that you have adequate protection against potential damages and legal fees.

Protection Against Unforeseen Events

Additional coverage options, such as roadside assistance and rental car coverage, can help protect you in the event of unforeseen events, such as a breakdown or accident. These coverage options provide the support and resources needed to get back on the road quickly and safely.

Seeking Legal Help After an Accident

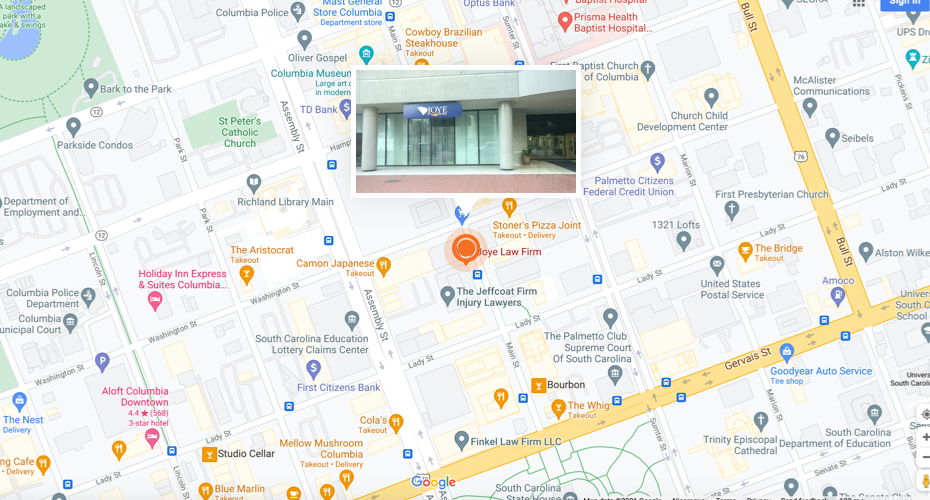

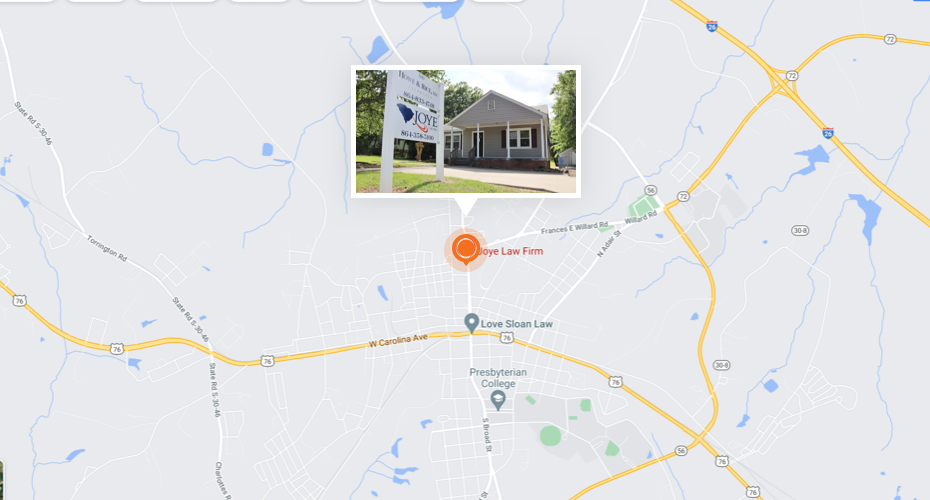

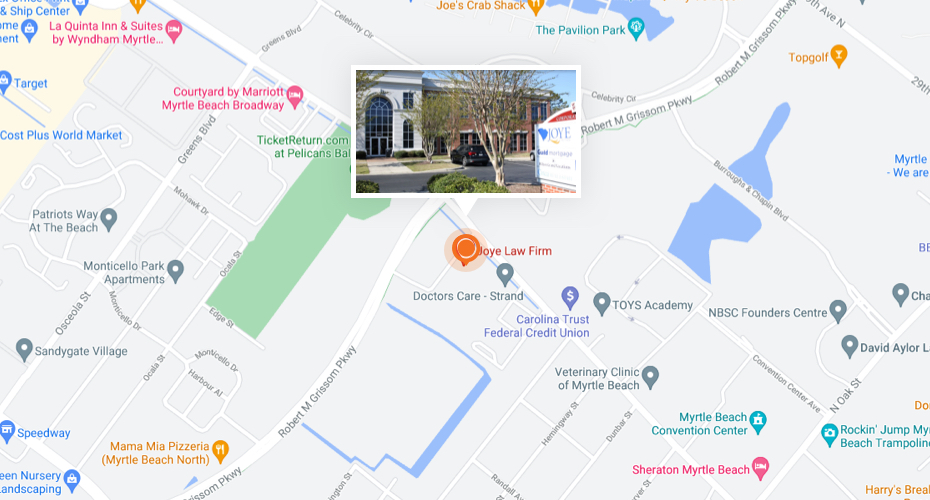

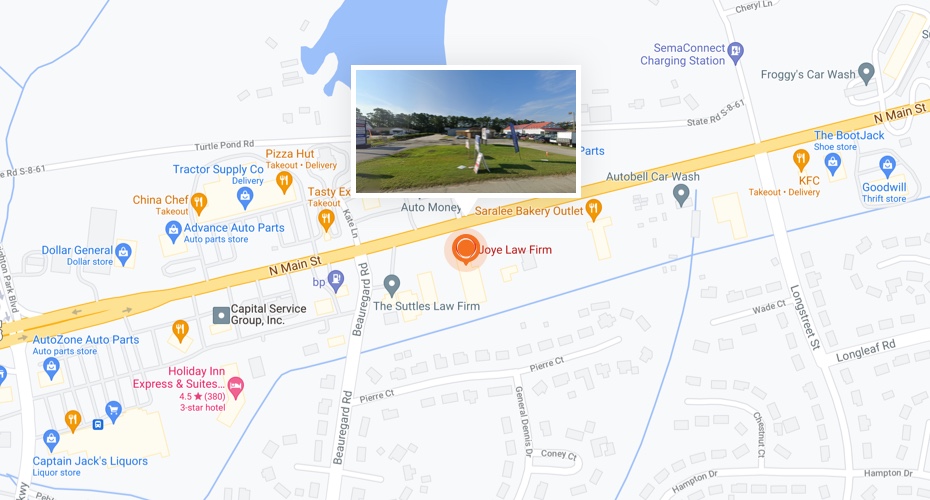

If you have been involved in a car accident, seeking legal advice from a reputable and experienced law firm is crucial. Joye Law Firm is a trusted law firm that has been serving clients in South Carolina for over 50 years.

Our team of skilled attorneys can help you navigate the legal system, negotiate with insurance companies, and fight for the compensation you deserve. Whether you are dealing with property damage, injuries, or other losses, Joye Law Firm can provide the support and guidance you need during this challenging time.

Contact Joye Law Firm today to schedule a consultation and learn more about how we can help you.