The purpose of the Employee Retirement Income Security Act (ERISA) is to protect employees who are counting on retirement benefits or pensions that their employer promised them.

ERISA sets guidelines and rules for how employee retirement funds must be managed and establishes strict guidelines for when and how employees earn a non-forfeitable interest in promised pension benefits.

It also provides a remedy for employees if their pension funds are mismanaged, and the Pension Benefit Guaranty Company provides a source of funding to pay out benefits in the event that an employer fails to pay out defined benefits as promised.

The purpose of the Employee Retirement Income Security Act (ERISA) is to protect employees who are counting on retirement benefits or pensions that their employer promised to provide after they leave employment. ERISA includes requirements for maintaining and paying out benefits as defined by retirement plans and benefit plans (e.g., long-term disability insurance).

ERISA sets guidelines and rules for how employee retirement funds and benefit plans must be managed and establishes strict guidelines for when and how employees earn a non-forfeitable interest in promised pension benefits.

Vesting schedules under ERISA play a crucial role in determining when employees are entitled to receive the full benefits of their pension plans. Vesting is the process by which an employee accrues non-forfeitable rights over employer-contributed pension funds.

There are generally two types of vesting schedules recognized by ERISA: ‘cliff vesting’ and ‘graded vesting.’ Under cliff vesting, employees must work for a certain number of years before they acquire a 100% vested interest in their pension plan.

Graded vesting, on the other hand, allows employees to gradually accrue vested benefits over time, with a percentage increasing each year until reaching 100%. The specific terms of vesting schedules can vary between plans, but ERISA sets minimum standards to ensure that employees don’t lose out on rightfully earned pension benefits due to overly restrictive vesting requirements.

The ERISA law also requires plans to establish grievance and appeals processes that participants may pursue if benefit payments are disputed. It gives participants the right to sue for unpaid benefits and over plan administrators’ breaches of fiduciary duty. Under ERISA, plan administrators are held to a high standard of conduct because they act as fiduciaries to the plan participants and beneficiaries. Fiduciaries are required to act solely in the interest of the participants and their beneficiaries, with the exclusive purpose of providing benefits and defraying reasonable expenses of administering the plan. ERISA also provides a remedy for employees if their pension funds are mismanaged. The Pension Benefit Guaranty Company provides a source of funding to pay benefits in the event that an employer fails to pay out defined benefits as promised.

ERISA enforces strict compliance with its provisions by imposing significant penalties for violations. These penalties can be both civil and criminal, depending on the nature of the violation. Civil penalties often include monetary fines and may require the restoration of losses to the plan or the provision of any unjustly gained profits made through improper use of plan assets. In more severe cases, where fiduciaries have willfully violated ERISA standards, criminal charges can be brought, leading to fines and even imprisonment.

When an ERISA-covered pension plan is terminated, ERISA mandates that plan participants must be notified about the termination in a timely and clear manner. This notification should provide details about the reasons for termination and the consequences for participants’ benefits. In the case of a defined benefit plan, ERISA provides additional security through the Pension Benefit Guaranty Corporation, which ensures that employees will still receive their pension benefits up to a certain limit, even if the plan lacks sufficient funds.

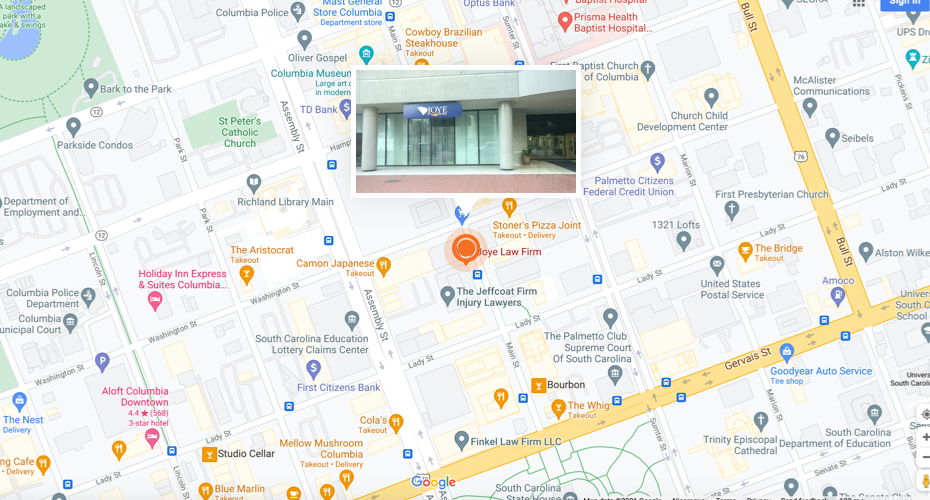

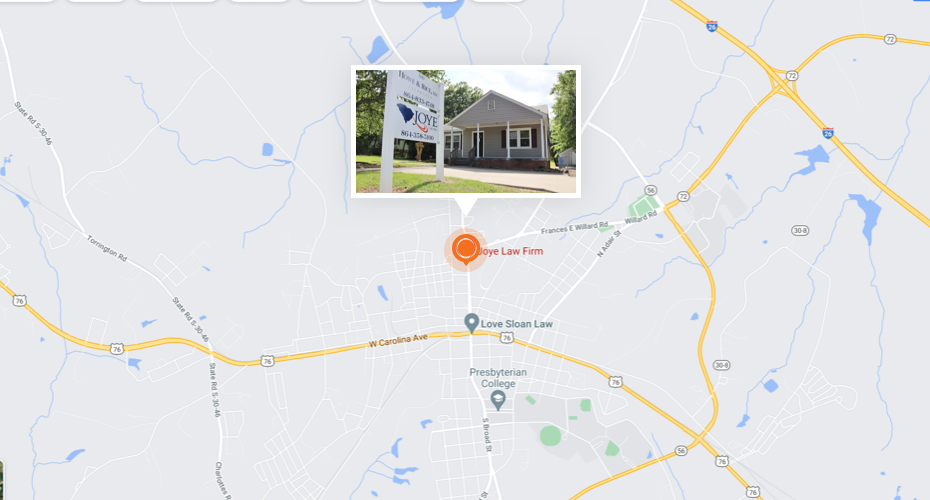

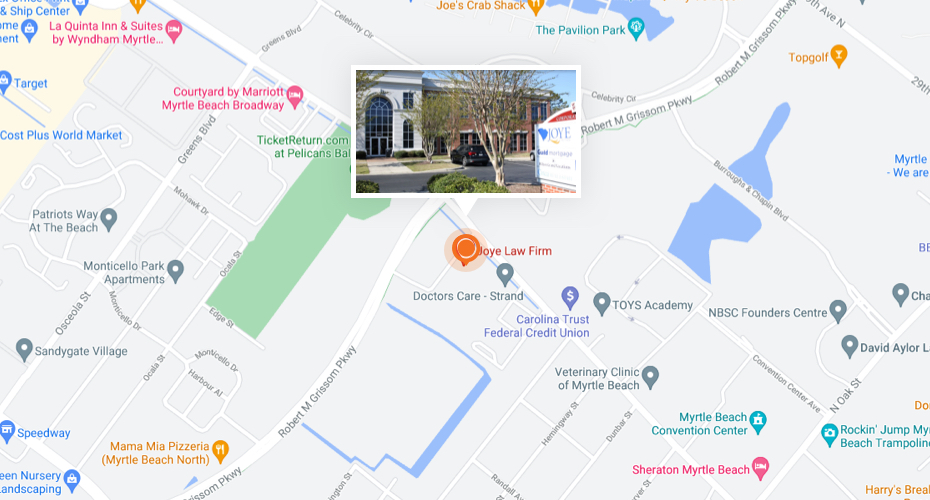

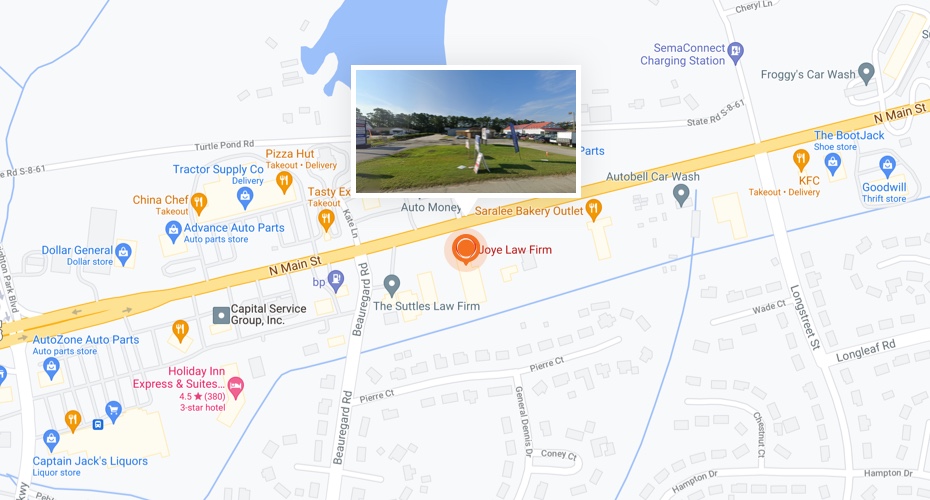

If you have been denied pension or healthcare benefits that you were promised by a former employer, contact a South Carolina lawyer at Joye Law Firm. We work with a network of highly skilled attorneys across the state to ensure that every case receives the attention it deserves.

Phone (888) 324-3100 or fill out our online contact form for a free and confidential claim evaluation.

Does ERISA Apply to My Benefits?

ERISA ensures that benefits that are part of an employee’s retirement or severance package are provided as promised. The language of the ERISA law refers to employer-provided benefits as “employee welfare benefit plans.” The law applies to plans established and maintained by an employer to provide benefits to current or former employees or their beneficiaries.

ERISA applies to numerous types of benefit plans:

- Defined-benefit and defined-contribution retirement funds (pensions).

- Insurance plans, including HMO/group insurance plans, such as health and medical care insurance.

- 419(e) Welfare Benefits Plans, including and 419(a)(f)(6) plans.

- Health savings accounts (HRAs) that are funded through pre-tax contributions.

- Flexible spending accounts (FSAs).

- Dental insurance plans.

- Prescription drug plans.

- Vision plans.

- Disability insurance.

- Long-term care insurance plans.

- Business travel insurance.

- Unemployment benefits.

- Scholarship plans.

- Housing assistance plans.

- Training plans.

- Vacation plans.

- Pre-paid legal service plans.

After a job loss, understanding your health insurance options is crucial, and ERISA plays a key role in this context through COBRA (Consolidated Omnibus Budget Reconciliation Act). COBRA gives workers and their families who lose their health benefits the right to choose to continue group health benefits provided by their group health plan for limited periods under certain circumstances, such as voluntary or involuntary job loss.